The history of "PRESTIGE" Company can be broadly divided into two phases: the first, its operation as an insurance company—PrJSC "PRESTIGE Insurance Company" (2012–2024)—and the second, its current activity as an insurance intermediary—PrJSC "PRESTIGE Company" (from October 2024 onwards).

PHASE ONE: INSURANCE COMPANY (2012–2024)

Establishment and Licensing

PrJSC "PRESTIGE Insurance Company" was founded in July 2012. By August of the same year, the company had been registered as a financial institution. Its founders were Ukrainian citizens, individuals with over 20 years of experience in the insurance sector.

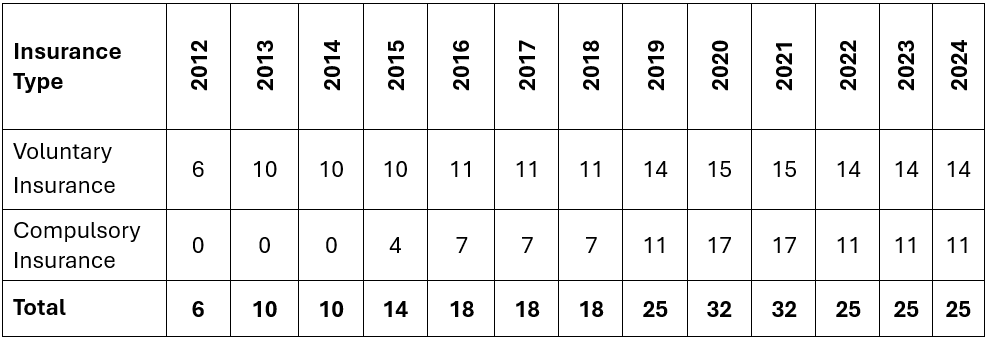

Between 2012 and 2021, the company obtained 25 licenses for conducting insurance activities: 14 for voluntary types and 11 for compulsory types of insurance. On April 22, 2024, the company received new licenses from the National Bank of Ukraine for direct insurance and inward reinsurance across 14 classes.

Methodology and Insurance Products

The company developed over 50 insurance products, enabling it to actively expand its service portfolio and market penetration. The dynamics of license acquisition underscore the company's consistent growth and development.

Table: Dynamics of the Number of Licenses Obtained by PRESTIGE Insurance Company for Voluntary and Compulsory Types of Insurance, units.

Online Products and Innovations

Since September 2018, the official website of PRESTIGE Insurance Company has featured online policy issuance functionality. This marked a significant step towards the digitalization of services and enhanced customer convenience. From that point, clients could remotely process policies from anywhere in the world. Key online products available on the website included:

- Voluntary insurance for foreign travelers in Ukraine against COVID-19 infection;

- Compulsory third-party liability insurance for dog owners;

- Compulsory third-party liability insurance for firearms owners;

- Voluntary accident insurance;

- Voluntary travel insurance for outbound travelers (including COVID-19 infection risk);

- Compulsory civil liability insurance for owners of ground vehicles (OSCPV);

- Compulsory civil liability insurance for owners of ground vehicles for international travel ("Green Card") from partner insurers.

Accreditations and International Operations

From 2013 to 2025, the company was accredited by NJSC "NADRA UKRAINY." Furthermore, the company was accredited by the German Consulate and listed among insurers providing travel insurance to EU/Schengen Area countries in accordance with the requirements of the EU Visa Code. In 2020, travel insurance with a COVID-19 option for international travel was introduced. The company ensured 24/7 high-quality service for its clients under concluded agreements anywhere in the world, thanks to fruitful cooperation with leading assistance companies in Ukraine.

Clients and Partnerships

The company focused on cooperation with corporate clients, while insurance for individuals, particularly transport risks, was conducted as an intermediary. Partners included leading insurers such as PrJSC "Knyazha VIG," PJSC "NASK "ORANTA," PrJSC "USG VIG," PrJSC "European Insurance Alliance," PrJSC IC "Euroins Ukraine," and others.

The company boasts successful experience participating in tenders and providing insurance guarantees within the Prozorro system for clients such as PJSC "Ukrzaliznytsia," SE "NEC "UKRENERGO," SE "Ukrainian State Centre of Radio Frequencies," local self-government bodies, military units, and other state and commercial enterprises.

Among the company's clients were LLC "UKRPROMMASH," LLC "TRANSLOC," NPO "ROMSAT," LLC "TECHMASH," LLC "Merezha Lanet," LLC "Epicentr K," PJSC "KB "ACCORDBANK," LLC "LVT Engineering," JSC "Ukrzaliznytsia," SE "Adidas-Ukraine," JSC "Dniprovagonrembud," LLC Joint Ukrainian-German Enterprise Hoch-Bereh Ltd, LLC "VAGO," G.V. Kurdyumov Institute of Metal Physics of the National Academy of Sciences of Ukraine, and many others.

Mutually Beneficial Partnerships

The company consistently pursued long-term partnerships, which allowed it to explore new market segments, expand its geographical presence, and influence the development of Ukraine's insurance market. In April 2018, the company received accreditation with PJSC "KB "ACCORDBANK" and initiated active cooperation.

Development of Online Sales and Partner Activities

The company acted as an insurance intermediary in the sale of compulsory civil liability insurance policies for owners of ground vehicles (OSCPV), as well as international motor insurance "Green Card" policies.

Within this scope of activity, PRESTIGE Insurance Company successfully cooperated with leading insurance companies in Ukraine, including PJSC "NASK "ORANTA", JSC "IC "CREDO", PJSC "IC "PZU", PJSC "IC "USG", PrJSC "IC "European Insurance Alliance" and other partners.

Thanks to effective cooperation with reliable insurers, the company provides a wide selection of insurance products and high-quality customer service.

Structural Divisions and Regional Network

The management of PrJSC "PRESTIGE Insurance Company" dedicated significant attention to developing its regional network, establishing separate structural divisions in accordance with the needs of corporate clients and the company's Development Concept. During the company's operations, nine separate structural divisions were opened.

Directorates and Branches

- Zakarpattia Directorate. Established on January 13, 2014, in the central part of Uzhhorod. Its primary clients are individuals, state, and communal enterprises within the Zakarpattia region. The directorate continues its operations as part of the insurance intermediary PrJSC "PRESTIGE Company";

- Lviv Directorate. Registered on July 25, 2014, and located in the "Pivdennyi" shopping center in Lviv. It focused on the shopping center's tenants and clients of Ukrinbank. It ceased operations after four years;

- Vinnytsia Directorate. Served clients of PJSC "Ukrkoopsilka" and legal entities in the region. Main clients are currently individuals. The directorate continues its operations as part of the insurance intermediary PrJSC "PRESTIGE Company";

- Kharkiv Directorate. Established in 2015 based on the client base of licensing authorities. It ceased operations after a year and a half;

- Zhytomyr Directorate. Opened on March 10, 2016. It focused on individuals, agents, and driving schools. It ceased operations after two years;

- Kherson Directorate. Opened on June 22, 2018, based on the DOSAAF driving school. Its main focus was cooperation with driving school students and individuals. It closed after five years of operation due to the full-scale Russian invasion;

- Volyn Directorate (Lutsk). Founded on May 17, 2019, based on its client base and cooperation with the banking sector. It ceased operations after two years;

- Zaporizhzhia Directorate. Opened in November 2020, focusing on individuals. It ceased operations after one year;

- Boiarka Branch. Established in July 2023, based on the existing agency network. It exclusively serves individuals and continues its operations as part of the insurance intermediary PrJSC "PRESTIGE Company."

Current Structure

As of today, the company is represented by three active subdivisions:

- Zakarpattia Directorate (Uzhhorod).

- Boiarka Branch (Boiarka).

- Bershad Branch (Bershad city, Vinnytsia region).

Agency Network and Sales

Since 2017, the company has actively developed its agency channel in cooperation with insurers specializing in motor insurance. During this period, between 20 and 40 active insurance agents collaborated with the company. Sales volumes reached up to UAH 1.5 million per month, or approximately 1600–1800 concluded insurance policies.

Regulatory Transformation

On July 1, 2020, the National Bank of Ukraine became the regulator of the Ukrainian insurance market. This was a result of the country's European integration course and a signed memorandum between the European Union and the President of Ukraine concerning the creation of a mega-regulator for the non-bank financial sector.

Since its inception, the company's shareholders have consistently adhered to the principles of transparency, client-centricity, and responsibility. These values remain the foundation of the company's operations even today.

Operating Conditions During Russia's Full-Scale Invasion of Ukraine

The company's operations in 2022—during the onset of Russia's full-scale aggression against Ukraine—deserve particular attention.

Emergency Preparedness. Prior to February 24, 2022, the company anticipated possible actions from Russia, yet did not expect an invasion of such magnitude. Given the escalating tension, the company's management took a series of preventive measures in advance: on February 14–15, personnel were transitioned to remote work; salary advances were paid 5 days early; and employees were advised to purchase food and essential supplies.

First Weeks of the War. Following the start of the full-scale invasion on February 24, 2022, the company effectively suspended operational activities until mid-March. The primary focus was on the safety of employees and their families.

The situation was particularly challenging for employees residing in Irpin, Kyiv region—one-third of the company's staff remained there for over two weeks under constant shelling. Some employees stayed in Kyiv, where hostilities also continued.

Despite the difficult circumstances, the company managed to:

- Evacuate statutory documents and security certificates;

- Timely pay taxes for 2021;

- Maintain constant communication with personnel;

- Promptly respond to changes in legislation and recommendations from state authorities.

Organizing Work in Wartime Conditions. From March 1 to March 30, 2022, the company officially suspended operations due to reasons beyond employee control. During this period, the company:

- Developed instructions for actions in emergency situations and during air raids;

- Informed clients about the possibility of remote claims settlement;

- Relocated most employees to the western regions of Ukraine.

In the second half of March, after the evacuation was completed, the company gradually resumed operations. Remote work functions were established, made possible by the experience gained during the COVID-19 pandemic.

Resumption and Stabilization. The company's information infrastructure, internal processes, and methodology remained functional. Remote work ensured the continuity of client service.

The most significant achievements during this period were the preservation of:

- The team — as the company's core value;

- The client base — through trust and responsibility;

- Obligations to clients — which were fulfilled in full;

- Operational stability — considering new challenges and security measures.

Advertising and Marketing

Digital Presence and Information Transparency. Since 2013, "PRESTIGE" Company has maintained an official website, which provides mandatory information about the insurer's activities as a financial institution, including details about the joint-stock company (issuer information).

A unique feature of the website is its provision of reference materials for policyholders and students studying insurance-related disciplines. Specifically, the site hosts: a "Glossary of Insurance Terms," "Insurance Legislation," "Tips for the Insured," and a "For Students" section with presentations on "Insurance" and "Insurance Management" courses.

Social Responsibility and Educational Activities. Since the company's inception, its employees have annually participated in the organization, sponsorship, and engagement in sports, educational, and socially significant events. The company implements a socially oriented policy, particularly through:

- Lectures and open presentations for students and faculty of leading universities;

- Support for sporting events, including Ukrainian Air Force tennis tournaments, volleyball competitions, and children's festivals;

- Participation in scientific conferences, seminars, and accreditation committees;

- Sponsorship of children's sports leagues and events for employees' families.

Among the key events were:

- Tennis tournaments of the Ukrainian Air Force (2014, 2015, 2016);

- Volleyball initiatives in support of the wounded (Irpin, 2014);

- Lectures by Chairman of the Board Yevhen Brydun in Khmelnytskyi, Kyiv, and Irpin;

- Defense of A.V. Lytvyn's dissertation for the degree of Candidate of Economic Sciences and PhD in Finance on January 28, 2016, at the Vadym Hetman Kyiv National Economic University. The research supervisor was Yevhen V. Brydun, Candidate of Economic Sciences, Associate Professor of the Finance Department at National University of "Kyiv-Mohyla Academy," and Chairman of the Board of "PRESTIGE Insurance Company." The research topic, "Modeling Anti-Crisis Financial Management Processes in the Activities of Insurance Companies in Ukraine," was directly related to the practical activities of the research supervisor (2016);

- Participation in international conferences, notably the Turkish (2021) and Carpathian Insurance Conferences (2020);

- Sponsorship of the Ukrainian Girls' Volleyball Championship (2023–2024);

- Participation in the "Dad, Mom, and I are a Sports Family" festival (2023).

Internet Marketing and Advertising

Since 2018, the company has actively utilized digital channels to promote its services. Specifically, it has implemented advertising campaigns through: Google Ads, Google Business, Facebook Business Suite, Facebook Ads Manager, and Corporate social media pages.

This has significantly expanded audience reach, increased brand recognition, and provided convenient access to insurance products.

From 2018–2021, the company was a member of the "Insurance Business" association, which unites participants in the Ukrainian insurance market.

The company's official slogan is:

WE PROTECT YOUR DREAMS!

This slogan is registered as a trademark according to Certificate No. 298769, issued by the National Intellectual Property Authority (UKRPATENT) on June 2, 2021.

Information Technologies

Implementation of a Comprehensive Information System. In 2019, PRESTIGE Insurance Company developed and implemented the "Prestige Insurance" Comprehensive Information System. This system provides a full cycle of insurance contract support for both front-office and back-office operations. It also includes a module for conducting client financial monitoring in accordance with the requirements of the National Bank of Ukraine.

Financial and Economic Consulting

As part of its partnership with LLC "Institute of Financial Solutions", the company provides clients with services in financial and economic consulting, including:

- Selection of partner banks;

- Tax and financial planning;

- Management accounting;

- Staff training;

- Research on economic issues;

- Automation of financial monitoring;

- Other outsourced financial services.

Automation of Financial Monitoring

Given the increasing complexity of the financial environment and the volume of operations, the company places particular emphasis on the automation of financial monitoring processes. To this end, a dedicated "Financial Monitoring" module was created within the "Prestige Insurance" system, performing the following functions:

- Module development using modern web technologies;

- Implementation of data protection mechanisms for authorized users;

- Generation of standard client questionnaires;

- Verification of clients for affiliation with Russia and Belarus (for legal entities and individual entrepreneurs), presence on sanctions or terrorist lists, and politically exposed person (PEP) status or connections to PEPs;

- Group client verification and maintenance of verification logs;

- Monitoring changes in the Unified State Register of Enterprises and Organizations of Ukraine;

- Generation of a draft client ownership structure;

- Assessment of legal entities' risk profiles;

- Automatic assignment of risk levels to clients;

- Automatic generation of client profiles;

- Determination of repeat verification frequency;

- Generation of internal and external reports (including for the NBU);

- Compliance with Ukrainian legislation requirements in the field of financial monitoring.

Financial Performance and Taxes Paid

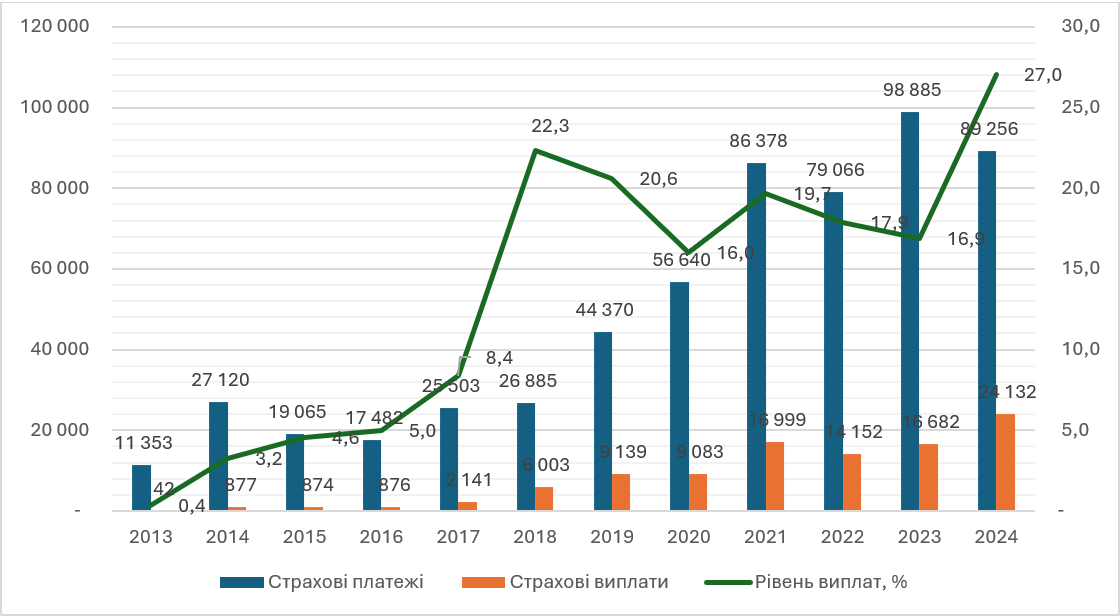

By the end of 2024, the volume of collected insurance premiums by PrJSC "PRESTIGE Insurance Company" and PrJSC "PRESTIGE Company" totaled:

- UAH 89.26 million from direct insurance contracts;

- UAH 19.62 million from the partner (intermediary) channel.

The total premium volume amounted to UAH 108.87 million.

In 2024, the company made insurance payments totaling UAH 24.13 million, corresponding to a payout ratio of 27.04%.

Structure of the Insurance Portfolio (2024):

- Personal Insurance: 3.43%;

- Cargo Insurance: 28.95%;

- OSCPV (via partner channel): 13.08%;

- Liability Insurance: 5.48%;

- Property Insurance: 37.54%;

- Green Card: 2.09%;

- CASCO (via partner channel): 1.01%;

- Inward Reinsurance: 2.73%;

- Other Types of Insurance: 5.69%.

Partner Sales Channel

The company sells policies for the following types of insurance:

- Compulsory civil liability insurance for owners of ground vehicles (OSCPV);

- Auto CASCO;

- "Green Card";

- Other types of insurance.

In 2024, UAH 17.14 million was collected through the partner channel, specifically:

- OSCPV: UAH 14.07 million (9.1 thousand policies), of which:

- Electronic policies: UAH 12.23 million (87% of the total).

- Green Card: UAH 2.26 million (481 policies).

- CASCO: UAH 806.75 thousand.

For comparison, in 2023, the premium volume for OSCPV was UAH 12.68 million (9.6 thousand policies).

Structure of Policyholders

The company primarily focuses on working with legal entities. By policyholder status: 71.35% of premiums are from legal entities; 26.53% from individuals; and 2.12% from reinsurers.

Tax Burden and Taxation Systems

Throughout 2013–2024, the company operated under two taxation systems:

- 2012–2013: Insurance payments (net of reinsurance) at a 3% rate; financial and other activities at an 18% rate;

- From 2014 to present: Tax on gross income from insurance activities at 3%; corporate income tax on financial and other activities at 18%.

Since 2015, profit from insurance activities has also been taxed at an 18% rate, supplementing the 3% tax on gross insurance income.

Table: Formation of Financial Results of Insurance Activities for PrJSC "PRESTIGE Insurance Company" in 2013-2024, thousand UAH

The data presented in the table clearly indicate a substantial year-on-year growth in gross premiums. Specifically, in 2014, there was a 139% increase in their volume compared to 2013. However, during 2015–2016, insurance premiums experienced a 35% decline. This contraction in premiums points to a reduction in the company's revenue and, consequently, the amount of income tax paid. Subsequently, in 2017–2018, the indicator increased by 54%, reaching UAH 26,885 thousand by the end of the period. This demonstrates a recovery in the company's income and a 0.63-fold increase in the income tax paid. The volume of gross premiums received between 2013 and 2018 signals an expansion of the company's market share, primarily driven by the growth of its client base through compulsory insurance lines.

The company's operational activity shows consistent growth, with the financial result increasing from UAH 340.59 thousand in 2013 to UAH 813.6 thousand in 2014, an increment of UAH 473.01 thousand. This surge is directly attributable to a UAH 15,767 thousand increase in insurance receipts. The positive trend in insurance payments consequently leads to higher tax revenues remitted to the State Budget of Ukraine, as illustrated in the accompanying figure.

Fig. - Dynamics of insurance premiums and insurance payments of the "PRESTIGE" Insurance Company in the period 2013-2024, thousand UAH.

PHASE TWO: EXCLUSIVE OPERATION AS AN INSURANCE INTERMEDIARY (FROM SEPTEMBER 2024 – PRESENT)

Since October 30, 2024, PrJSC "PRESTIGE Company" has continued its operations exclusively as an insurance intermediary, leveraging its extensive experience in the Ukrainian insurance market.

Contemporary Operating Model

The company collaborates with leading Ukrainian insurance companies, enabling it to offer clients a broad spectrum of insurance products tailored to their specific needs, budgets, and the current security environment.

Advantages for Clients

By choosing "PRESTIGE" as their insurance intermediary, clients gain:

- Access to the Best Insurance Offers. The company is not limited to products from a single insurer; instead, it meticulously selects the most advantageous insurance options available across the entire market;

- Individualized Approach. Qualified specialists assist in risk assessment, understanding insurance terms, and selecting optimal coverage;

- Time and Effort Savings. Clients do not need to compare offers independently—"PRESTIGE" provides ready-made solutions;

- Reliability and Confidence. The company partners exclusively with financially stable insurers, guaranteeing timely payouts;

- Professional Support at All Stages. From consultations to claims settlement, "PRESTIGE" consistently advocates for its clients;

- Personalized Solutions. The company offers individual insurance programs, coordinated with partner insurers, that consider each client's unique circumstances;

- Transparency and Honesty. The company provides comprehensive information on insurance terms, exclusions, and policy costs—without hidden fees.

Adaptation to the Security Situation

The company conducts its operations with due consideration for: curfew regulations; air raid alert protocols; and recommendations from state authorities regarding safety. This ensures uninterrupted client service even under challenging conditions.